[Photos by Agathè Yosefina & Rohan G on Unsplash]

Welcome to the ninth edition of The Growth Factor Fortnightly (TGF Fortnightly). The newsletter explores some of the biggest questions around small businesses through the stories of MSME owners, bankers, investors, customers, employees and technologists.

In this edition

- Unintended consequences of price control

- Mark Zuckerberg on messaging commerce

- Algorithms for SMEs

- MUDRA loans during the lockdown

The unintended consequences of price control

Back in 2006, Financial Express carried an interesting report on what happened to part time teachers when West Bengal imposed a minimum wage. FE wrote:

“Around 160 colleges under Calcutta University employ part-time teachers to fill the gap in permanent teachers. The part-timers get either Rs 2,000 for six classes a week or Rs 75 each class. They do not get any other benefits. Months ago, state finance minister Asim Dasgupta promised to address the gross injustice against part-timers who are post-graduates. He told the part-timers that they would get Rs 4,000 a month and the state would take on the additional financial burden. The only condition is that the colleges have to justify the engagement of part-time teachers. Today, the part-time teachers are jobless.”

The sounds of history echoes in surprising places. Now, Financial Times reports on the possible impact of a recent Supreme Court ruling in China, demanding shadow banks cut the interest rates they charge significantly—to 15% from about 24% now. FT writes:

“Beijing hopes the move will prevent SMEs, which are a significant employer, from falling victim to exorbitant interest rates. But analysts warned the rules would make underground loans, a lifeline for many small businesses with little access to traditional bank lending, harder to obtain.

“‘Interest rate control ends up hurting the very group of borrowers it intends to protect as they are priced out of the market,’ said Zhang Min’an, a law professor at Sun Yat-sen University in Guangzhou.”

Shadow banking has a fascinating history. Here’s a timeline

- November 9, 2004 | Informal lenders in China pose risks to banking system - The New York Times

- October 15, 2011 | China cracks down on informal lending | WSJ

- June 20, 2019 | Chinese P2P lending platforms look to Southeast Asia amid industry purge back home - TechNode

- January 17, 2020 | China’s shadow bankers sneak back to market | Reuters

- August 18, 2020 | China culls almost 6,000 P2P lenders in industry crackdown - FinTech Futures

- August 21, 2020 | China just killed its $491 billion private loan market - Bloomberg

Mark Zuckerberg on messaging commerce

[Photo by Anthony Quintano from Honolulu, HI, United States / CC BY]

In the recent earnings call, Facebook CEO Mark Zuckerberg said he was excited about what he called ‘messaging commerce’, and by that he meant “conducting a significant portion of their business over Messenger or over WhatsApp.” Earlier this year, Facebook invested $ 5.7 billion for a 9.9% stake in Jio Platforms. He sees a huge scope for messaging commerce in India.

Zuckerberg said:

“A lot of people use WhatsApp, especially in India. There's a huge opportunity to enable small businesses and individuals in India to buy and sell things through WhatsApp. We want to enable that. That starts with enabling payments. A big part of the partnership that we have with Jio will be to wire up and get thousands of kiranas, small businesses, across India onboarded onto WhatsApp to do commerce there.

“And we're really excited about the opportunity there. And once we prove that out with Jio in India, we're planning on expanding it to more folks in India and to other countries as well. But there's no doubt that India is a huge opportunity. It is the largest country by the size of our community that we're serving already, and it should be one of the faster-growing business opportunities as well to help businesses grow there, and we're very excited about that.”

Integrating WhatsApp with India’s Unified Payments Interface will likely help push messaging commerce further. But, Facebook is still awaiting RBI approval for a full scale launch.

Algorithms for SMEs

Two people born in the 1940s believe they can help Indian SMEs.

Sam Altman, Max L. Heine Professor of Finance, Emeritus, at the Stern School of Business, New York University, came up with a model to predict bankruptcies in 1968. The model, Z-Score, is still considered the gold standard for large companies. Later, in 2015, Prof Altman and Dr. Gabriele Sabato developed a model for the Italian stock exchange to assess the risk of small businesses. They eventually set up a company called Wiserfunding. They opened an India office in June, right in the midst of the Covid-19 pandemic, to use the model for India’s credit assessment model. They had in fact started on the project long before the pandemic. One of the biggest bottlenecks in MSME financing is that lenders don’t know if their loans might turn bad. It could help in that.

Romesh Wadhwani was born six or seven years after Altman in Karachi, moved to the US, and runs Symphony Technology Group (STG), a private equity firm for software, internet and technology services companies. He also co-founded Wadhwani Institute for Artificial Intelligence in Mumbai which aims to use AI for public good. His foundation launched a Rs 200 crore initiative called Sahayata Business Stability Program to help 10,000 SMEs in the country. In an interview to The Economic Times, he explained that it will partner with banks and consulting firms, and also deploy a technology platform that will help SMEs wade through the crisis. “By January, 2021, our platform will be a fully self-serviced AI powered platform. That will make it possible for SMEs to go directly to that platform and be assisted in terms of thinking about important business issues around survival, stability and growth.”

Dig Deeper

Chart of the week | Mudra loans during the lockdown

By Vasisht Balaji Srinivasan

By many counts, Pradhan Mantri MUDRA Yojana, launched in 2015, can be considered a success. The scheme promised to be a smooth and easily accessible source of funding for micro-level MSMEs. It was designed to give MSME owners, especially individuals, relatively hassle-free loans ranging up to Rs 10 lakh. These loans were routed through banks, NBFCs and microfinance institutions all over the country and could be used for a variety of requirements, from buying assets to financing working capital needs.

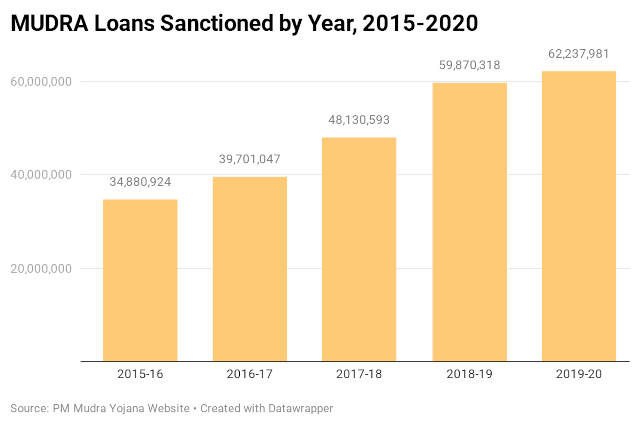

The number of loans sanctioned went up by nearly 80% between 2015-16 and 2019-20. The amount sanctioned and disbursed more than doubled during this time.

- However, its performance during the pandemic is debatable. While in 2019-20, the average number of loans per month was 52 lakh, this year the number had dropped to 15 lakh a month. The total amount sanctioned dropped from Rs 28,122 crore per month in the previous financial year to about Rs 11,000 crore per month in 2020-21. Some have argued that the loans picked up only during the second half during the previous year, and it might be the case again this year. However, loans are most needed now, when the economy is down.

- Nearly 15% of SBI’s MUDRA loan portfolio has gone bad over the lockdown period. Now, there have been rising NPA numbers in the MUDRA loan sector, and it isn’t a good sign for SBI, one of the biggest lenders. The largest delinquency has been in the Shishu segment, with loans not exceeding Rs 50,000. The bank’s chairman Rajnish Kumar said that the entire process had been digitized. Are banks taking a cue from Fintech? (We explored this topic in our previous edition—see here.)

- According to a recent ET article, microfinance lenders have been able to maintain a robust repayment schedule. Do banks have something to learn from them?

- Many NBFCs are lobbying for the Emergency Credit Loan Guarantee Scheme to cover individuals as well, so that MUDRA loanees may benefit too. Could this help change the NPA rates?

This fortnightly newsletter is curated by Founding Fuel’s senior writer NS Ramnath, who is researching industrial clusters in Tamil Nadu on a Bharat Inclusion Fellowship. Bharat Inclusion Fellowship, an initiative of CIIE.CO of IIM, Ahmedabad, is aimed at addressing the knowledge gaps that prevent entrepreneurs from developing effective solutions for the underserved.

TGF Fortnightly will share insights from his research and reporting. The newsletter is a part of the conversation we will have with our community—on our website, over video conferences, webinars and a Discourse platform we are setting up. We will keep you posted.

Please do share this newsletter with friends and colleagues who might be interested in this theme. If you received this as a forward, you can subscribe here. Thanks for being a part of what promises to be an incredible journey of learning and insights.