[Image by Gerd Altmann from Pixabay]

Welcome to the eighth edition of The Growth Factor Fortnightly (TGF Fortnightly). The newsletter explores some of the biggest questions around small businesses through the stories of MSME owners, bankers, investors, customers, employees and technologists.

In this edition

- Why MSMEs should look at climate financing

- Small teams, big networks

- Fintech’s golden years?

Why MSMEs should look at climate financing

In the early days of the coronavirus pandemic, when everyone’s attention, justifiably, was on the damage the virus will cause the world, one of my friends forwarded a cartoon, which depicted two big waves hitting the shores. The first wave—the wave of coronavirus—was big. But the second wave, which the cartoon warned will soon hit us, was even bigger, and it was labelled climate change. A series of news—the rise in temperature of the arctic, the forest fires in the Amazon—were the real-world reminders of what’s to come. More recently, someone sent me another cartoon, which was more micro. The cartoon zoomed in on two fish in the ocean. Both had a worried look. One was stuck inside a glove, and the other was being dragged by a mask. We have been dumping coronavirus waste into our oceans.

In a recent piece in IDR, Ankit Gupta and Santosh Kumar Singh from Intellecap point out MSMEs’ interesting relationship with climate change. MSMEs cause climate change, and are vulnerable to the risks posed by it. And therefore, they argue, MSMEs must invest in technologies that mitigate climate change, and climate finance could help them. Only, it’s not happening because many MSMEs don’t even know such an option exists, they are mostly cut off from any formal finance, and put off by procedural requirements. Their answer: climate finance institutions must actively pursue MSMEs, reduce the barriers, and instead of focusing only on direct finance, should look at new instruments such as default guarantees.

There has been a lot of noise around climate financing recently, in part because its champions believe it can be a game-changer. A recent piece in The Economist warns against overselling the instrument. “The greening trend could be a force for good in the fight to reduce climate change. But the role that financial services can play must not be misunderstood or overstated. The sector is responding to changes in government and broader circles of opinion, not driving change itself. And there is a limit as to how much it can do,” The Economist wrote.

However, as far as climate financing for MSMEs is concerned, hype is not much of a concern because very few are even talking about it. And making the sector ready for climate financing will also make it ready for financing in general.

Now, here’s a short story and a question

- Some years ago an NGO distributed insecticide-treated mosquito nets in a village to protect the residents against malaria. However, many of them had a more fundamental need—of earning a livelihood. They ended up using the mosquito nets as fishing nets. What that eventually led to is a story for another day, but here’s a question. Is it possible that an aggressive push for a specific type of financing might actually slow down the supply of more basic financing? Should the system focus on getting financing right, before going for climate financing?

Small teams, big networks

[Photo by Antoine Plüss on Unsplash]

We have heard hundreds of stories from some of the smartest people about the wisdom of having small teams. Jeff Bezos has the “two pizza rule”: limit the group size so it will take just two pizzas to feed all its members. When Steve Jobs was building the Mac during his first innings at Apple, he didn’t want his team to grow beyond 100 people. Jobs apparently said, “I can’t remember more than a hundred first names so I only want to be around people that I know personally. So if it gets bigger than a hundred people, it will force us to go to a different organization structure where I can’t work that way. The way I like to work is where I touch everything.” And then there is Dunbar’s number, which says that humans have the cognitive capacity to deal only with 150 people or less.

Large teams can become unwieldy. Small teams are good. But, that’s only if we can choose the team. Bezos and Jobs, obviously, could afford to choose them.

It plays out differently when we talk about the poor. A microfinance company CEO once told me that most of the people they catered to never moved beyond a five kilometer radius. This restricts the people they deal with, their opportunities and their access.

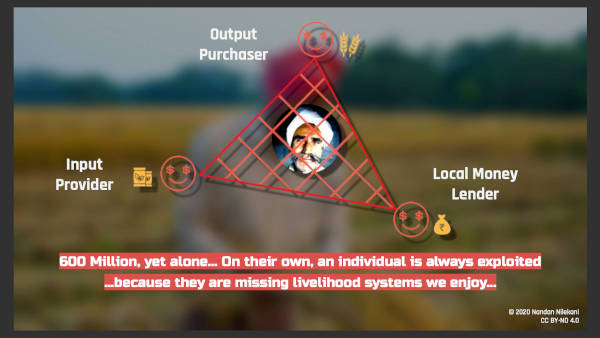

In a recent presentation, Nandan Nilekani said, “They are basically caught between the input provider, which could be a fertilizer seller; the output purchaser who buys their produce and the lender. They're caught in this trap—whether it's an MSME or a farmer, and this informality of their livelihood is the heart of what we need to crack as we go forward.”

He said that meant three things need to be done:

- We have to digitize the money flow (will move faster than cash)

- We have to make their assets visible (will establish creditworthiness)

- We want them to get access to markets in a much more globalized way (so they are not locked into one buyer in the village.)

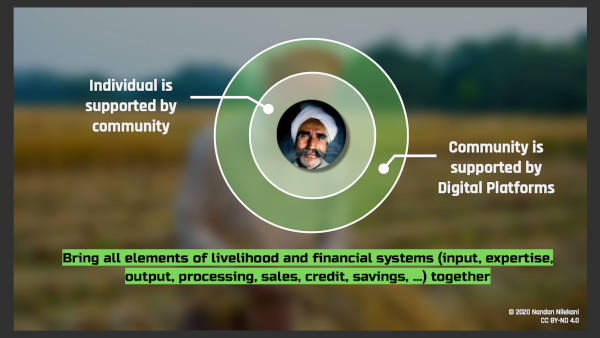

To do that, he said, we need to enlist the community’s help, and the community in turn, should be supported by digital platforms.

Nilekani shared the deck and a recording of his speech on Twitter—here.

Here’s the question

- There’s a widely held belief that people who have traditionally built communities in the development sector are not very open to using technologies. Would you agree? Are there examples of the traditional development sector using technology in a way that has helped the communities they served?

Chart of the Week: Fintech’s golden years?

By Vasisht Balaji Srinivasan

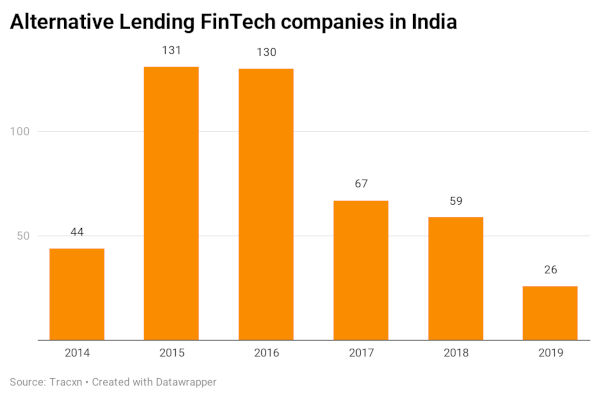

Amidst the barrage of bad news that we seem to be getting from all quarters, there seems to be one corner that’s doing fine. Fintech companies. According to India Fintech Report 2020 by Medici, the first six months saw investments of $1.47 billion into the sector, up 60% from the same period last year. Industry’s best time? Not quite. We would go back five or six years with that tag.

- The chart above shows that more than 250 alternative lending fintech platforms came up between 2015 and 2016. The optimism around digital was riding really high during those two years. Aadhaar was touching 1 billion enrollments. Jan Dhan Yojana was picking speed. UPI was in the works. Mobile phones were growing.

- A lot of the companies established in 2015 and 2016 are now getting VC funding that will help them increase their loan books.Take MoneyTap, for example. The app-based fintech company recently raised close to Rs 500 crore in equity and debt, and plans to increase its loan book to Rs 5,000 crore (from the existing Rs 1,000 crore) in the next 12-18 months. They secured an NBFC license from the RBI last year.

Here are a few questions we have for you:

- As an MSME owner, have you interacted with any fintech lenders? How has your experience been?

- Are alternative lending fintechs going to become an easier (and more accessible) source of finance for MSMEs in all parts of the country?

- A recent study conducted by IIT-Madras on MSMEs in Tamil Nadu showed that close to 31% of MSME owners sought moneylenders for their credit needs during the lockdown. Do you think there’s an opportunity in there?

This fortnightly newsletter is curated by Founding Fuel’s senior writer NS Ramnath, who is researching industrial clusters in Tamil Nadu on a Bharat Inclusion Fellowship. Bharat Inclusion Fellowship, an initiative of CIIE.CO of IIM, Ahmedabad, is aimed at addressing the knowledge gaps that prevent entrepreneurs from developing effective solutions for the underserved.

TGF Fortnightly will share insights from his research and reporting. The newsletter is a part of the conversation we will have with our community—on our website, over video conferences, webinars and a Discourse platform we are setting up. We will keep you posted.

Please do share this newsletter with friends and colleagues who might be interested in this theme. If you received this as a forward, you can subscribe here. Thanks for being a part of what promises to be an incredible journey of learning and insights.