[From Unsplash]

Good morning,

Many startups including Paytm, Zomato and Freshworks which went for an IPO in the last few months saw their share price drop below the issue price. Since many of them were backed by VCs, some of the attention has turned on them too. In fact, the scope of the scrutiny has expanded to governance and the impact they have on society, especially after journalists surfaced hyper-aggressive, even toxic culture in many of these startups.

Given all these, Sebastian Mallaby’s new book on the venture capital industry, The Power Law, takes a rather sympathetic view of the industry. He is asking us not to jump to conclusions especially with regards to some of the common criticisms against the industry. For example, consider this extract that comes at the end of the book.

“Of course, Big Tech has a dark side. Companies as huge as Amazon, Apple, Facebook, and Google have all kinds of social impacts, some good and some not, and governments are right to clamp down on the bad stuff. Violations of privacy, the propagation of fake news, and the sheer power of private actors to determine who gets to communicate when and to whom: these are legitimate targets for regulators. But this is not an indictment of venture capital. When VCs originally backed the tech giants, they were helping to create products that were good for consumers; nobody wants to return to a world without e-commerce, personal computers, social media, or web search. If the giants have since become threatening, this is because they have become so large: the VC/startup stage in their trajectory is long behind them. Nor can it be argued that VCs somehow programmed irresponsibility into these companies when they were in their cradles. If anything, the opposite is true: the majority of VCs tend to push founders to be more careful about legal and societal constraints, not less so. At Facebook, Accel ejected Sean Parker in an attempt to cleanse the culture of the firm. At Uber, Benchmark ultimately defenestrated Kalanick. Meanwhile, venture capitalists have backed dozens of technologies that are obvious boons: digital maps, online education, biotechnology, and so forth. The companies that VCs create are much more a force for progress than a source of regression.”

Let us know what you think.

Newspapers battle to go digital

Last week, The Times of India offered pointers to how the print media got battered after the pandemic hit. Advertisers from whom a bulk of the revenues came were among the first to flee. Just when things started to show a semblance of return to normalcy, the crisis in Ukraine broke out. “The ocean freight costs of newsprint to India have jumped four times in the last two years due to these disruptions.”

As things are, from $450 per tonne in 2019, it is now $950 per tonne. And newsprint prices alone are 40-50% the cost of a newspaper. While the problem isn’t entirely new, the current situation has only exacerbated the issues and publishers in India find themselves in a jam. That is why the push to go digital and acquire paying subscribers. This, however, takes a long while.

While there aren’t many pointers yet from India on how to transition to the digital model, entities from other parts of the world such as Financial Times have been at work on just this and have gotten to 1 million subscribers. Just how did they get there, stay at this threshold and continue to grow? Jon Slade, the company’s commercial chief, spoke about the company’s learnings in a conversation with Digiday and we read it with much interest.

Over time, they witness big spikes and bumps from big news events and are at work to establish a playbook to retain people who come in. “We know we are going to see a big increase in audience around a big news event and we want to hold onto that audience. So the first thing to do is to manage the price effectively, so the price they pay when they come in won’t lead to an enormous shock in 12 months when it comes to renewal. Otherwise, that’s a surefire way to lose people. We treat them as a specific cohort of audience—people who come in as for big news events. It allows you to separate them from other marketing, communications and renewal pricing. We treat them as a distinct set of our audience.

“The other thing we’ve learned is the faster you can get them engaged in content other than the thing they came in for, the better. So if you came into the FT because you were really trying to understand what was happening with Trump and US politics, we are going to make sure you get in your personalized feed and in your newsletters and in your communications from us as much US politics as you could possibly want. But we are also going to find out what the other sets of content are which we think might be interesting to you. We use data analysis for that. You come in for the depth, but our job is to get you across the breadth as quickly as we can.”

Dig deeper

- How the FT got to 1 million subscribers (Digiday)

- How the Ukraine war has created a crisis for India newspapers (Times of India)

Life outside Excel

In a recent column Morgan Housel draws our attention to the difference between understanding something in theory versus living through something.

He writes: “I don’t think there’s any way to understand what a bear market feels like until you’ve lived through one.

“Part of the reason is that it’s impossible to contextualize what causes losses until they happen. If I say to you, ‘How would you feel if the market fell 30%?’ you imagine a world where everything is the same as it is today, but stock prices are 30% cheaper. And in that world, it feels like an opportunity. But what actually makes the market fall 30% is a pandemic that might kill you, or a recession where you might lose your job, or a terrorist attack that might just be beginning, or inflation with no end in sight. And in that world—a world that can’t be known until it happens—things feel different. Saying ‘I’ll be greedy when others are fearful’ is easier than actually doing it, because people underestimate the odds of themselves becoming one of the ‘others.’”

Housel shares Jim Carrey’s quote, which implies the same thing: “I think everybody should get rich and famous and do everything they ever dreamed of so they can see that it’s not the answer.”

Dig deeper

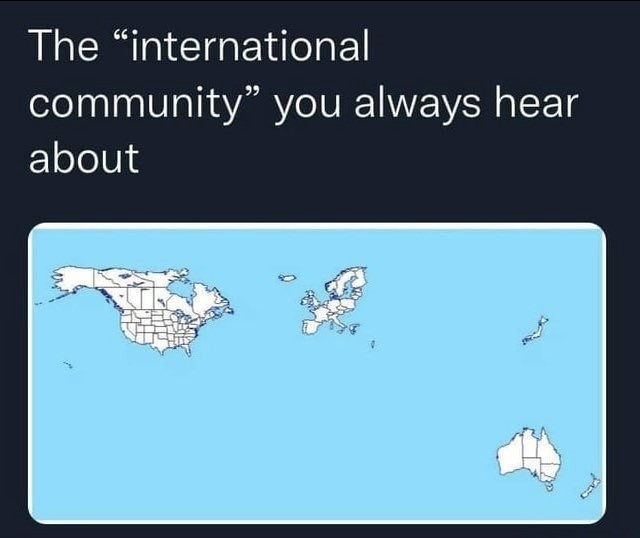

The global world order

(Via WhatsApp)

Found anything interesting and noteworthy? Send it to us and we will share it through this newsletter.

And if you missed previous editions of this newsletter, they’re all archived here.

Warm regards,

Team Founding Fuel